Like most people, you need a safe and dependable transportation to go to work, come back home, do your grocery shopping and maybe drive kids to and from school. However, unlike those lucky few, you don’t have perfect credit. Does that mean you don’t get a car, ever? Absolutely not. Even if you have bad credit, there’s always a way to get a reliable vehicle.

However, qualifying for a lease can be tricky. No matter what those peppy car ads on TV may tell you, it’s not easy for everyone to lease a car. In reality, most people who have trouble qualifying for a loan to purchase a car, have a hard time qualifying for a lease as well. Still, a little bit of research and preparation can go a long way and help you get a fair lease deal – even if you have bad credit.

Image source: thebalancemoney.com

Know Your Numbers

First things first – how bad is your credit score? It’s crucial you understand the numbers, as lenders use your credit score to determine whether or not to lease you a car, and they determine this based on how likely you are to return the cash you borrow. So, any information about your previous borrowing, as well as your money-managing skills (or rather previous behaviors) are taken into account. Practically speaking, because most credit scores range from 500 and below to 720 and above, the higher this number, the better your chances. For instance, many lenders will not lease you a car if your credit is anywhere around 600 (even 620 is considered “bad credit”), simply because they find the score too risky.

However, the main reason why it’s important to know your numbers, is because some lenders will try to exaggerate the problem of your credit score to get you to pay more or more frequently than usual (instead of a monthly payment, they may demand bi-weekly or weekly payments), so do your research thoroughly – the more you know about your own situation, the better you’ll be.

Do Your Research

Before you start visiting car dealers, do your research into what might be available to someone with your credit score. Be realistic here – if your credit is really bad (say, around or below 600), look for cheaper vehicles. In fact, even if your credit is bad going towards average, it’s a good idea to look for inexpensive cars for two reasons:

- They’re easier to qualify for,

- They have lower monthly payments.

And here is another tip – look for cars that are not selling and will soon be replaced with updated models. When dealers are worried a model may be stuck on their lot for an extended period of time, they’re much more likely to make a deal, even with a customer with bad credit.

Improve Your Credit Score

Since your credit score is the most important factor dealers take into account when you apply for a lease, if at all possible, try to improve it before you apply.

You want to start by reviewing and fixing any potential errors on your credit report – believe it or not, removing incorrect entries can sometimes raise your numbers to a much, much more acceptable level, so take your time, review and fix what can be fixed. Just to prepare you, this can sometimes take a few months, depending on how long you haven’t checked your credit report.

Then, try to pay off your credit cards. Your past credit utilization tells a lot about your future credit behavior, so make sure you pay off credit card balances to improve your score.

Finally, don’t apply for new loans. Whenever you apply for a new loan (and yes, that includes new credit for a car loan), your scores go down. So try to limit your applications as much as possible.

Provide a Proof of Income

Make sure you can provide a proof of a stable income. It’s best if your proof income shows:

- It’s steady (you can bring a few of your pay stubs for proof)

- You can pay both your bills and your monthly lease.

Also, if you can, provide several personal references that show you’re not a credit risk. The references should state you’re responsible and preferably come from current and former employers. However, prominent people in your community count too. All of these things help out a lot and make you a more desirable lease candidate.

Shop Around

Having a bad credit is not the end of the world (you’d be surprised at how many people have bad credit scores!) and it doesn’t mean you can’t get a good deal. To avoid paying a lot of cash, and get the best possible deal you can, arm yourself with patience and shop around.

People, and especially dealers, tend to function differently when they know there’s competition around. So if you can, get lease quotes from as many lenders as possible which you can use when you find the vehicle you want. Show the quotes to the lender who has your ideal car and let them work to your advantage. Sometimes, these quotes can mean a difference between getting a car you want and being denied.

Have Some Cash Saved

There’s no going around this one – the worse your credit score, the more money you’ll have to pay for a down payment. This is understandable from a lender’s perspective, as bad credit means risky business, but is, nevertheless, a huge con of leasing a car with bad credit. So if you have a pretty bad credit score, forget about what the car ads tell you – the dealer is highly likely to demand a larger down payment or money you pay up front, so it’s more than wise to have some cash saved.

Also, as mentioned, some sneaky lenders will try to take advantage of your bad credit by demanding you to make more frequent payments than normal. For instance, instead of normal monthly payments, they may demand you to make bi-weekly or even weekly payments. Shameful, yes, but still a reality for many.

These were some basic tips and tricks that can help you lease a car with bad credit scores. However, sometimes, no matter how well you do your research and prepare yourself, things don’t go as planned. If that’s the case with you – it’s still too early to throw in a towel. Here are a couple of other options that you can try.

Get a Co-Signer

If you’ve tried everything but cannot qualify for a lease, consider getting a co-signer. It’s best to go with a family member or a best friend here who don’t mind being held responsible for the payments in case you’re not able to pay. Obviously, the plan should never be to make your co-singer stuck with bills, but it’s a good idea to know what happens in such scenarios:

- If you don’t pay: you co-singer will have to pay all the remaining payments,

- If you both don’t pay: the car gets repossessed and you and your co-signer end up with damaged credit. Also, in this case, you’re both liable to pay for any value deficiency the business has when they dispose of the vehicle. Clearly, a scenario you want to avoid at all costs.

Try a Lease Swap

It’s not unusual for people to break their leases. This can be an excellent opportunity for someone with bad credit to take over – all you have to do is find a person willing to do a lease swap, or lease transfer, and ask them to take over their lease. What happens here is you take over a car along with the remaining term of a lease from the original financer (previous owner).

Although these are also subject to approval, this is a case of the previous owner approving the lease, not a lender, which is often a much better option for people with bad credit scores, simply because original owners usually want to get out of a lease as quickly as possible.

There are various ways you can go about this, but the two most well-known websites who specialize in pairing people who want to break their leases and people who want to take over other’s leases are SwapALease.com and LeaseTrader.com.

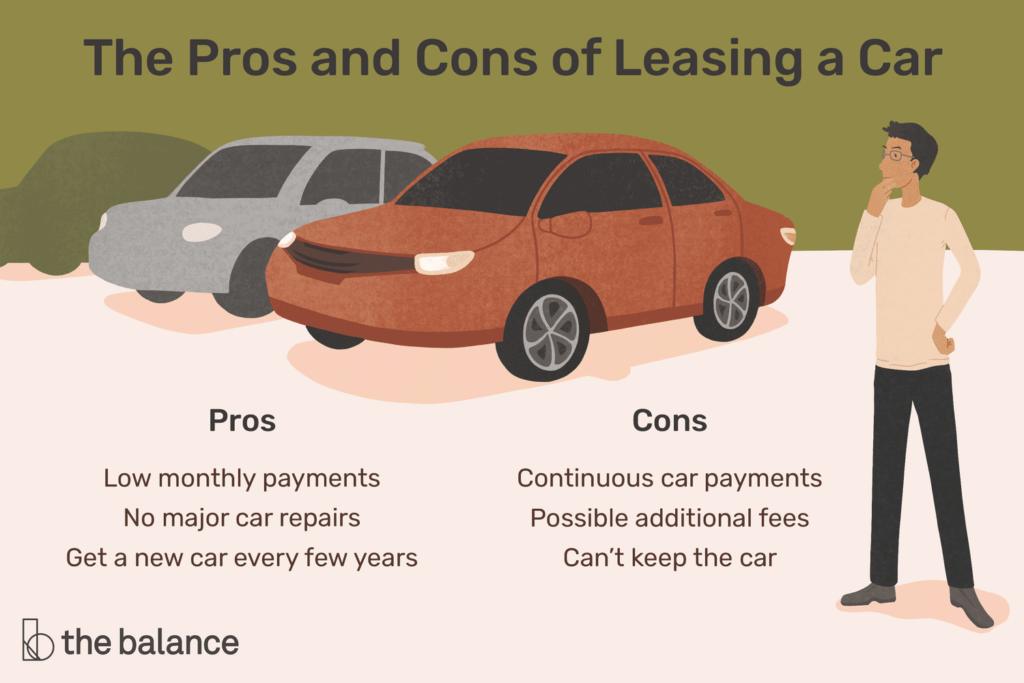

Now that we’ve covered all the steps you can take to lease a car with bad credit, it’s time we cover the benefits, as well as the cons of leasing a car – no matter your credit scores.

Pros of Leasing a Car

Leasing a car has many advantages, especially for consumers with bad credit. Here are some of the major pros you should keep in mind when thinking about leasing a car.

- Saving money

It’s always a good idea to try to save money, but if you have bad credit, it’s crucial. Instead of giving a really large sum of money up front or getting stuck into a long-term loan (which is what happens when you buy a car), you deal with low monthly payments. However, these payments depend largely on the model and your credit score – the higher the score, the lower the payments, and likewise, the lower the score, the higher the payments.

- Low maintenance

Because most leased cars are under the manufacturer’s warranty, you don’t need to worry about the maintenance. Basically, a manufacturer warranty covers most costs for regular repairs, which is great news if you hate uncertainty – with a leased car, you can be certain your car will be taken care of all throughout the term of the lease agreement.

- New car every few years

If you love novelty, car leasing is the way to go. Instead of actually buying the latest model with great equipment, you can simply lease it, drive it for a few years and then return it. Next!

- Better credit

Now here’s an interesting bit about car leasing – if you always make sure you pay your monthly payments on time, you can improve your credit score, even if you’re starting with bad credit. You end up with a great car, and after a while, a better credit, and as a result, an even better car in the future!

Cons of Leasing a Car

As with anything in life, there are disadvantages to leasing a car as well. Let’s cover some of the major ones.

- Losing money

You have bad credit and you want to save money, so you lease a car. However, you end up paying more than you would if you actually bought a car. How’s that possible?

If you have really bad credit scores, your interest rate will be higher on your lease. Plus, it’s likely you’ll meet a lender who’ll try (and succeed, if you’re not careful) to magnify your bad credit problem to get you to pay more. Also, a security deposit may be required in this case (however, it may be returned at the end of the lease).

- Mileage restrictions

Most leased cars come with mileage restrictions, so your vehicle may be limited to 10,000, 12,000 or 15,000 miles per year, depending on the model/lease company. If you go over that limit, you have to pay an excess mileage penalty. Although these penalties are not particularly expensive (usually 10-50 cents for every additional mile), it adds up and you can pay more than you bargained for.

- Extra charges for excessive wear

Although leased cars are under manufacturer’s warranty throughout the lease agreement, excessive wear and tear are not included. So if you get a dent your leased car, be prepared to pay extra.

- Getting out of a lease is difficult

If, for some reason, you need to get out of your lease before it expires, prepare for hefty fees and penalties – in other words, losing a lot of money. And unlike regular monthly payments, these costs all need to be paid at once. Of course, if you can, you can always try the lease swap, or finding someone willing to take on your car and lease payments.

Sources

- Can You Lease a Car With Bad Credit?, U.S. News & World Report

- How do I lease a car if I have bad credit?, Bankrate

- “What Credit Score is Needed to Lease a Car?” Minimum Approval Score (2018), BadCredit

Originally posted 2023-01-26 17:53:45.